|

1 Comment

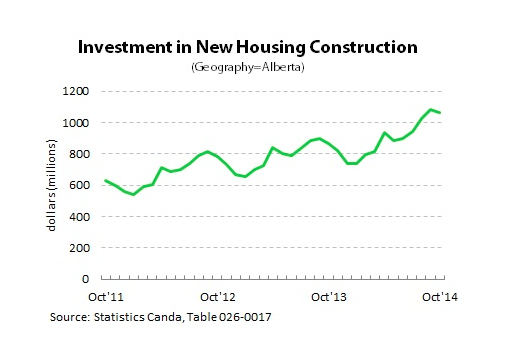

Investment in new housing construction reached the second highest level on record in Alberta last October. Statistics Canada reports that investment totaled close to $1.1 billion, a 23 per cent increase from 2013. Alberta easily beat out British Columbia and Ontario for the largest yearly increase in investment. B.C. saw new housing construction levels rise by 11 per cent, while Ontario experienced a five per cent expansion. Quebec posted the biggest decline in investment in new housing, down eight per cent. Investment was up year-over-year for all building types in our province in October. Apartments and row housing led the charge, rising by an astounding 54 per cent and 41 per cent respectively over the previous year’s levels; whereas double-detached and single-detached construction intentions only increased 24 per cent and 13 per cent. Cheaper mortgage lending rates have continued to support demand for new homes thus spurring greater investment in the housing sector. There is little concern about the prospect of interest rates rising within the next six months, meaning homebuilders should have little worry about higher rates destroying buyer demand. However, in spite of this, the residential sector is set to moderate in 2015. Slower population growth, cautious developers and a softer job market will impact the construction sector. In fact, building permits fell to just over 35,000 in December. As a result, a pullback in investment intentions in the residential construction sector is expected. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

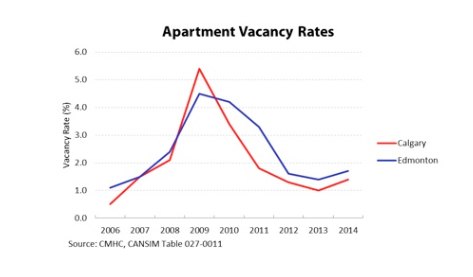

Apartment vacancy rates edged higher in October in both Edmonton and Calgary according to the fall rental market reports released by Canada Mortgage and Housing Corporation (CMHC). Alberta’s capital city experienced its first apartment vacancy rate increase since 2009, seeing its rate inch from 1.4 per cent in October 2013, to 1.7 per cent in October of this year. CMHC reports that even though the apartment vacancy rate rose softly, the rate itself is quite low and resulted in a rise in rental prices. The average rent for a two-bedroom apartment in Edmonton in October was $1,227 per month. Calgary also witnessed an increase in apartment vacancies after declining for four consecutive years. According to CMHC, the vacancy rate was 1.4 per cent in October, up from 1.0 per cent from a year prior. Calgary's average monthly rent for a two-bedroom apartment was $1,322 in October. The main reason for the rate increases comes down to basic supply and demand. The supply of apartments has been growing faster than the demand for units. In turn, this helped increase the vacancy rate in both cities this year. Although vacancy rates crept higher, they remained below the national average (2.8 per cent) thanks to high levels of migration, rising wages, and a favourable employment environment. **Article courtesy of Todd Hirsch, Senior Financial Advisor with ATB Financial. Thanks Todd!!

The question is, what does Bill 9 "The Condominium Amendment Property Act" involve? If you're thinking about purchasing a condo or you are currently an owner, this information is for you!

Below you'll find a summary of the key points of the Bill that has yet to be passed. **All info taken directly from http://www.servicealberta.ca/2166.cfm (Service Alberta) 1. Improve protection for buyers by:

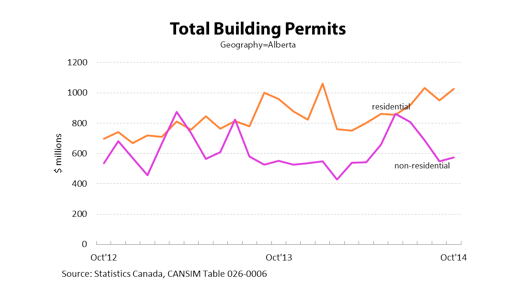

Below you'll find the 2015 RE/MAX Market Outlook Report Video and the report itself. The value of building permits issued by Alberta’s municipalities rose by $87 million in October to $1.6 billion, according to new figures released by Statistics Canada. The increase from September was due in large part to the rise in the value of residential projects in our province. After a small drop in September, residential permits rebounded and rose by eight per cent across our province in October. Since 2013, future spending by Alberta’s homebuilders has increased by almost the same amount (seven per cent). The jump in the total value of Alberta’s housing sector can be attributed to sustained demand from new provincial migrants. Permits for commercial projects picked up in October as well, where the total value of business-related building permits increased by $25 million (or by five per cent). Over the last twelve months, the total value of future construction spending in Alberta has increased by almost six per cent. Calgary’s housing sector continued to grow at a furious pace which helped lift the value of Alberta’s residential projects higher in October. The total value of housing permits in Alberta’s largest city grew by $44 million (+11 per cent) from September. Meanwhile, Edmonton’s biggest gains were made in the non-residential sector where the total value of commercial permits increased by $72 million (+37 per cent) from one month earlier. Additionally, Edmonton held almost half the value of all non-residential permits issued in our province in October. ** Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

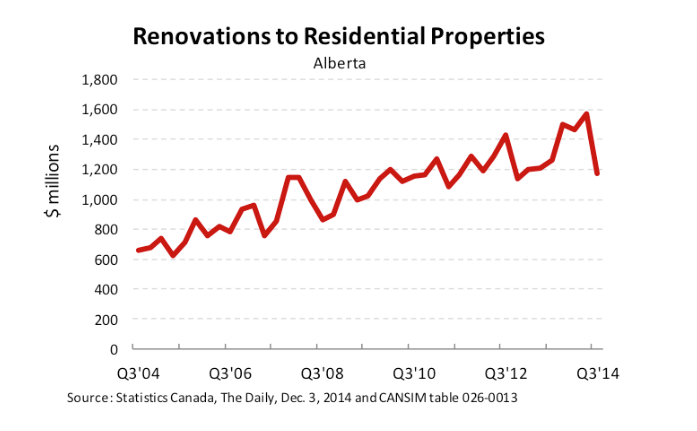

The proliferation of home renovation shows on TV may be an inspiration for some people to remodel their kitchen or add onto the family room. But last summer, it seems Albertans were perhaps spending more time watching TV than actually renovating. During the months of July, August and September of 2014, the value of renovations to residential properties fell to just under $1.18 billion—the lowest level it’s been in nearly two years and a sharp drop from the $1.6 billion record in the spring. The data were released this morning from Statistics Canada as part of its regular quarterly report on residential investment activity. Still, the big drop in the third quarter masks a longer term trend towards increased spending on renovations. Over the last ten years, investments on improvements to homes and condos have doubled. And even with the summer slump, total renovation spending over the last complete four quarters is up 19 per cent compared to the previous four quarters. There could also be some substitution effect taking place in the residential market. That is, rather than renovating their existing home to get that new kitchen or bigger media room, some Albertans may have opted instead to purchase a new home. Construction on new residential properties set close to record highs over the summer. Instead of hiring contractors to rip out walls and flooring—or even trying to do it themselves—it seems some Albertans may have opted simply to move into something new. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

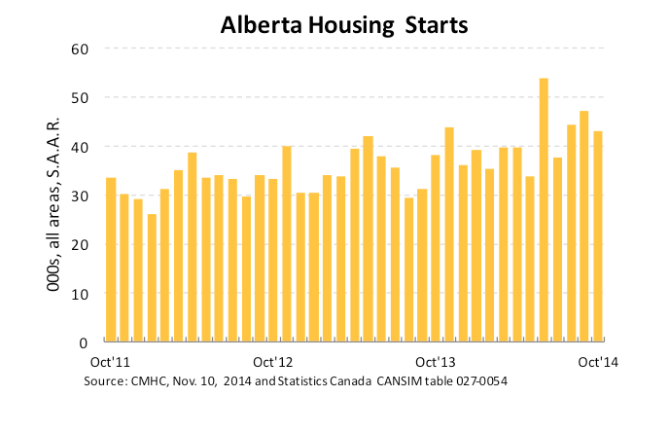

Despite a small pull-back in October, new home construction in Alberta continues to keep pace with the expanding economy and population. Last month, there were just over 43,000 new housing starts throughout the province. That figure is seasonally adjusted and at an annualized rate—that is, it estimates the number of new houses that would be built over an entire year if the pace of construction in October was to be maintained for twelve months. October’s figure is down slightly from September, but the longer-term trend in housing starts has been strong. Since the end of October 2013, housing starts are up almost 17 per cent compared to the previous 12-month period. Several factors in Alberta continue to push housing starts higher. With solid employment opportunities and high wages, Alberta continues to draw in thousands of workers from other provinces and around the world. That growing population needs places to live. Another factor is the rising cost of rental accommodation. With only a fixed number of houses or apartments for rent but growing demand, vacancy rates around the province are low. This has pushed up rents and made home ownership a relatively more attractive alternative. The third factor is continued low interest rates. For over four years, the Bank of Canada has kept its trend-setting overnight rate at a low one per cent—and that has helped maintain favourable mortgage rates. The low cost of borrowing money has pulled more Albertans into home ownership and increased the demand for new homes. **Article courtesy of Todd Hirsch of ATB Financial. Thanks as always Todd!!

The frenzied housing environment in both Edmonton and Calgary is expected to moderate over the next two years according to the Canada Mortgage and Housing Corporation’s (CMHC) most recent Fall Housing Market Outlook. After two years of significant gains in the new housing market, total housing starts in both cities are projected to soften through 2015 and 2016 as both employment growth and in-migration levels relax. In Calgary, the CMHC reports that total housing starts will reach record highs (17,200 units) by the end of this year. Multi-family starts (apartments, condos, etc.) are expected to reach their highest total since 1978 and will help lift housing starts to their record highs. Total housing starts for Calgary in 2015 are forecasted to reach 14,400 and 12,800 in 2016. Levels will moderate in Edmonton as well. Total housing starts are projected to reach 13,300 units in 2014 and then drop to 13,000 in 2015 and 12,300 in 2016. By the end of this year, the price of a new single-detached house in Edmonton is forecasted at $553,000 and $620,000 in Calgary. The CMHC acknowledges that Alberta’s hot job market, rising wages, significant in-migration numbers and affordable mortgage rates have propelled the existing home market in Alberta’s two major cities. Demand for resale homes in Edmonton and Calgary will continue to remain robust. However, as employment and migration gains slow and interest rates rise, sales in the resale market will start to cool too. By the end of 2014, the CMHC predicts the average resale price in Edmonton to be $360,000 and $459,000 in Calgary. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

|

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed