|

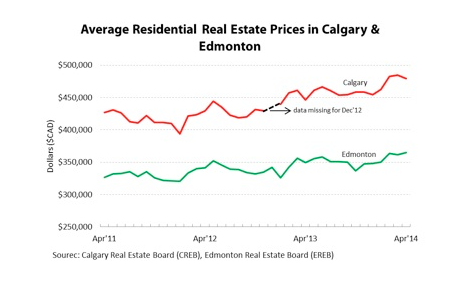

People looking to purchase an existing home in Calgary or Edmonton might be feeling irritated and discouraged. There isn’t a lot on the market these days and what is available is going up in price. In March 2014, Calgary’s total number of active residential listings reported by the Calgary Real Estate Board and the Canada Mortgage and Housing Corporation (CMHC) decreased 19 per cent (year-over-year). As a result, CMHC reports residential prices on the Multiple Listing Service (MLS) are expected to rise five per cent throughout 2014, to an average of $459,000. The average price in 2015 is anticipated to rise by three per cent to $472,000. The total number of active residential listings in Edmonton fell seven per cent in March (year-over-year). Prices increased 4.8 per cent year-over-year during the first quarter of 2014, reaching an average of $354,332. CMHC predicts the average MLS price in Edmonton will increase 4.1 per cent to $359,000, though it suggests demand and supply pressures could move closer to equilibrium in 2015, causing prices to slowly rise at around 2.2 per cent. Demand for existing homes in Alberta is the result of growing employment numbers and the influx of people moving here to take those jobs. Unfortunately, fewer listings and increasing prices in both cities are realities homebuyers will have to endure. There is an upside: as prices rise, more people will be inclined to list, which will boost supply. *Article kindly provided by Todd Hirsch of ATB Financial. Thanks Todd!!

0 Comments

Something that most folks who have lived in Alberta for more than a few months know, is that whether it's football, universities or our biz, real estate, there is always ongoing competition between the two power cities.

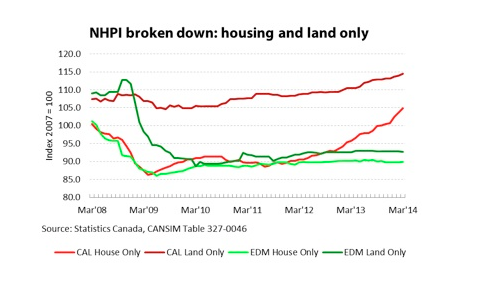

With record setting sales in May of 2014, Calgary's residential housing market continued its upward surge. We're talking about a 16% increase in sales over 2013. Some didn't think it possible that the residential values would be able to sustain a steady increase, but they have. Low interest rates have definitely helped. Single-family homes gained a 10% increase in value over last year. This astonishingly brought the average home price of this class up to $504,300. A $50K gain in one year. That goes for condo values too (10.7% increase). It's happening all around us every day in Calgary. New builds are up up up to the tune of 5,857 new units in the first quarter of 2014 alone. A substantial 64% increase over this quarter 2013. Incredible. An interesting fact is that apartment construction was the largest contributor to this gain. It's a multi-family heaven for those looking to get into brand new homes. To summarily quantify the magnitude of the transactions going on in Calgary ... The majority of sales occurring are between $300 and $500K. The number of listings in this bracket are however declining. Instead, higher up the market in the amounts closer to the millions and above, we're seeing a surge in new listings. A quick search of a portion of West Calgary (Springbank Hill, Slopes, Aspen, Coach Hill and a few more favourites) for homes valued at $1million or more revealed well over 120 listings. In fact, I have just executed a search for homes valued over $1 million in all of Calgary to find that there are currently 558 listings starting at $1million. Back to the topic at hand, the same search of our neighbours to the north in Edmonton has yielded 177 listings. Calgary seems to be leading the charge when it comes to high-end product availability. Calgary single-family sales and new listings for 2014 to date are 8,175 and 11,950 units respectively. That means that of the 5,177 real estate agents and brokers in Calgary, each one of them could have had a deal, and for many even two or three. There doesn't seem to be a stranglehold on business in that ratio, which is a great incentive for agents to do their best to represent as many listings as they can in this lucrative climate. Single-family sales and new listings for 2014 to date in Edmonton totalled 4,746 and 7,590 units respectively. Of course we have to take into account that Calgary has a couple hundred thousand more residents than Edmonton. We can see from the numbers that there are definitely some differences between the two real estate markets north and south. Both markets are performing very healthily, however one seems to be a little more active over the broad spectrum of analysis ;) What can both cities look forward to in the next few months? So far it has been smooth sailing. Good returns for sellers with homes that buyers can still afford? Praise that low interest rate right now. Without knowing what will actually happen tomorrow in the market, the absolute best thing you can do is work with an agent that you trust on an ongoing basis. Together you will be prepared to make your decisions based on real knowledge from real professionals right at that critical moment you need to. Alberta’s housing market is a tale of two cities. Since March of 2009, Calgary’s new house and land prices have increased 19.7 and 30.7 per cent, respectively. The story is a bit different in Alberta’s capital. The New Housing Price Index (NHPI) is calculated by using both contractors’ selling prices of new residential housing and their estimates of the current market price of the land. The NHPI is usually presented as one figure, but when we split Alberta’s to examine housing and land prices individually, we get a better look at the province's market. Developers and contractors continue to seek out viable land in Calgary, a demand that has been keeping prices up since 2009. Calgary’s prices for new homes are rising more sharply than contractors’ land price estimates. As the city's overall economy strengthens, demand for housing and usable land will rise. Edmonton is a different story. Since March 2009, the price of a new home has gone up 2.6 per cent. Contractors’ land price estimates have fallen 5.7 per cent. Both fell sharply in 2008 and haven’t seen any significant growth since the decline. It’s a mystery why Edmonton’s new housing prices and land estimates are still below 2007 levels. However, Edmonton’s healthy economy might help the numbers start to rebound. **Information provided by Todd Hirsch of ATB Financial. Thanks Todd!!

|

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed