|

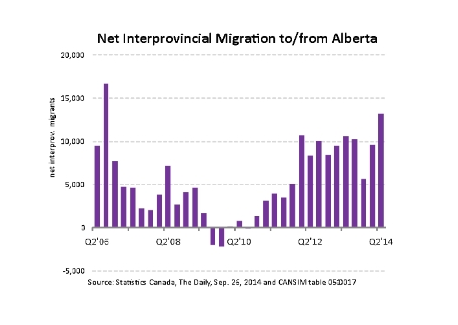

Job seekers from other provinces are ensuring Alberta continues to have the fastest growing population in Canada by a considerable measure. Over the months of April, May and June of this year, Alberta gained a net 13,204 new people from other parts of the country. (This figure is the difference between the number of in-migrants less the number of out-migrants.) That is the equivalent of Alberta adding another city the size of Camrose to its population in a matter of three months. Inter-provincial migration is only one component of Alberta’s population growth. Migrants from other countries, and natural population growth (i.e., births minus deaths), are also boosting the number of people who call Alberta their new home. The province’s total population now stands at 4,121,692, an increase of 2.8 per cent over the last year. The next two fastest growing provinces were our prairie neighbours: Saskatchewan (+1.7 per cent) and Manitoba (+1.3 per cent). Nationally, Canada’s total population grew by 1.1 per cent. The volume of inter-provincial migration in the second quarter was the greatest since 2006 when the province was experiencing a similar economic boom. The chart below shows the strong and steady flow of migrants from elsewhere in Canada in recent quarters. In the last two years, Alberta has gained more than 77,000 inter-provincial migrants—a reflection of great job opportunities and a desirable quality of life. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

0 Comments

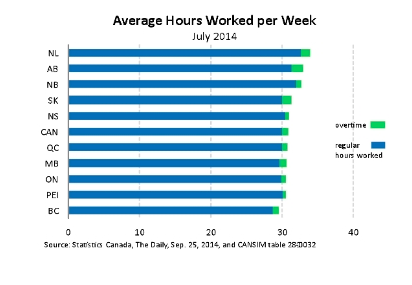

Albertans are known for working long hours, but according to the latest figures from Statistics Canada, employees in another province clock in about 54 minutes more per week. Employees in Alberta put in, on average, 31.3 hours of work per week in July. With an additional 1.7 hours of overtime, that makes for a 33-hour work week. People in Newfoundland and Labrador, on the other hand, work 33.9 hours a week—the longest weekly toil in the country. They do put in a bit less overtime than those in Alberta, though. Nationally, employees were on the job for an average of 30.9 hours per week (including overtime). The figures include both part-time and full-time workers, but do not include the self-employed. Strong economies in Alberta and Newfoundland and Labrador are credited (or blamed) for the long work hours. In Alberta, a lower ratio of part-time to full-time work is also a contributing factor. Workers on The Rock may work almost an hour more per week, but Albertans’ paycheques are by far the biggest in the country. Average weekly earnings were $1,153.81 in July, before taxes and adjusted for seasonality. That compares with the national average of $940.43. Not only do Alberta employees earn the most, their wages are increasing rapidly. Compared with July of last year, earnings are up 4.8 per cent—the third fastest rate among all provinces. It’s also nearly twice the annual increase in consumer price inflation, which rose 2.6 per cent in July. *Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

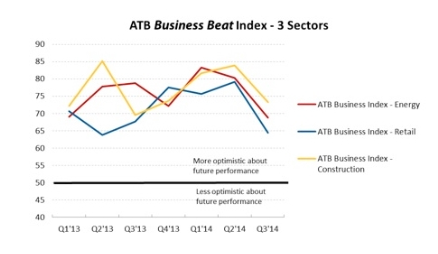

Business confidence amongst Alberta’s small and medium-sized businesses took a slide last quarter, according to ATB Financial’s most recent Business Beat Survey. Optimism in energy and construction dropped considerably, but the retail sector posted the biggest fall. Business confidence in retail slid by nearly 15 points to 64.4. Access to labour and changes to the Temporary Foreign Worker Program (TFWP) imposed in June are likely to blame. The TFWP was initially set up to help satisfy short term labour needs. This summer’s amendments have made it trickier and more costly for businesses to access temporary labour. Interestingly, 72 per cent of the respondents to ATB’s Business Beat Survey noted that the TFWP is necessary to combat the labour shortage here in Alberta. Plenty of public discourse has surfaced recently around the idea of such a shortage. Many economic indicators reveal that it may not exist in Alberta. However, ATB’s survey suggests Alberta’s businesses are in need of all labour types. Respondents agreed by 64 per cent that it is difficult to find Albertans to hire into unskilled positions, while 58 per cent agreed it is difficult to hire Albertans into skilled roles. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

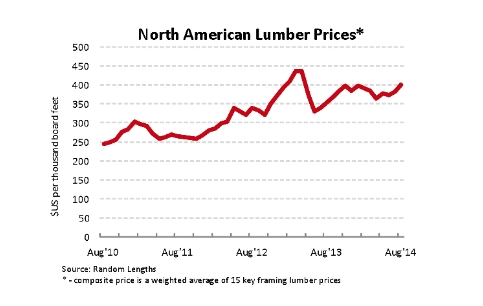

This year’s stabilization of lofty North American lumber prices is putting smiles on the faces of mill owners around Alberta. Lumber prices have been seeing better levels over the last few years due almost entirely to the revived housing market in the United States. After several years of struggling in the post-recession period, U.S. consumers are feeling more confident about their economy and job prospects. As a result, home builders south of the border are seeing some pent-up demand for new houses. A lot of framing lumber goes into those structures. Last month, the benchmark price for framing lumber was $401 (U.S.) per thousand board feet. That’s the highest it’s been in over a year and well above the 10-year average of $311 (U.S.). The benchmark price is calculated by Random Lengths, a U.S.-based forestry sector organization that tracks prices and industry issues. The composite price is a weighted average of 15 key framing lumber prices. The news is even better because of the soft Canadian dollar. The loonie was over parity with the U.S. greenback in 2013. Now, it sits around $0.91 (U.S). Lumber is priced in U.S. dollars but producers have to pay their operating costs in Canadian dollars, so the loonie’s relative weakness is boosting profits. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

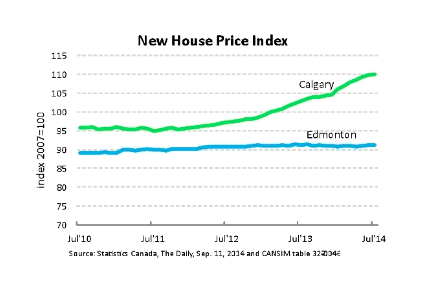

The rivalry between the Oilers and the Flames hasn’t even started for the season, but Alberta’s two cities are already battling it out—and this time, new home buyers in Edmonton are gaining the advantage. According to the latest information released this morning from Statistics Canada, the index of new home prices in Calgary reached 109.9 in July, an increase of 6.7 per cent over July of last year. Edmonton, however, continued to show no increase—its index was unchanged at 91.1. (The index sets prices in 2007 equal to 100. That means new residential prices in Calgary are higher by nearly ten per cent compared to seven years ago, while Edmonton new home buyers are seeing prices about nine per cent lower.) This ongoing split is odd given that new data show Edmonton’s population growth is outpacing Calgary’s. More people moving into the capital region should, in theory, boost housing demand and drive prices higher. The gap between the two cities can be attributed to higher land and building costs in Calgary. Statistics Canada states “builders (in Calgary) continued to report higher material and labour costs, good market conditions and higher costs for developed land as the reasons for the gain.” Land for residential development in and around Calgary has been somewhat restricted. This has limited the supply for home builders and boosted price. *Article courtesy of Todd Hirsch, Chief Economist with ATB Financial. Thanks Todd!!

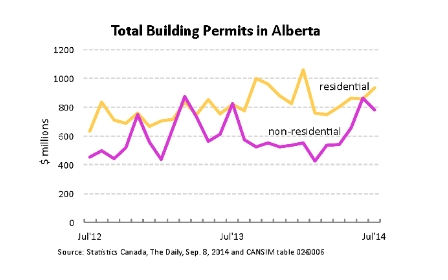

The cranes, bulldozers and cement trucks working on construction sites around the province aren’t going away any time soon, according to data released this morning from Statistics Canada. Municipalities throughout Alberta issued a total of $1.71 billion in building permits in July, essentially unchanged from June. The figure is adjusted for seasonality. The all-time record for the province was set in May 2007 with $1.84 billion in building permits issued. Since then, the total has exceeded $1.7 billion only three times—two of those times being in June and July of this summer. Building permits are a good sign of future activity—what economists call “leading indicators”—because permits must be secured in advance of any construction activity taking place. Residential permits were up 9 per cent from June to $933 million. Over the last twelve months, residential permits are 15 per cent compared to the previous twelve month period. That reflects solid income and labour markets, a growing population and plenty of demand for new houses and condos. Non-residential permits slipped to $780 million in July, essentially offsetting the increase in residential permits. However even with this dip, non-residential building activity is certain to remain a strong driver of the economy in 2015. Institutional and government building projects—largely made up of transportation infrastructure, schools, and hospitals—more than doubled in July to $143 million. Commercial projects fell a bit while industrial projects were unchanged. **Article courtesy of Todd Hirsch, Chief Economist at ATB Financial. Thanks Todd!!

|

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed