|

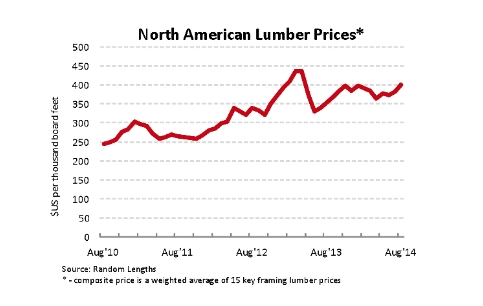

This year’s stabilization of lofty North American lumber prices is putting smiles on the faces of mill owners around Alberta. Lumber prices have been seeing better levels over the last few years due almost entirely to the revived housing market in the United States. After several years of struggling in the post-recession period, U.S. consumers are feeling more confident about their economy and job prospects. As a result, home builders south of the border are seeing some pent-up demand for new houses. A lot of framing lumber goes into those structures. Last month, the benchmark price for framing lumber was $401 (U.S.) per thousand board feet. That’s the highest it’s been in over a year and well above the 10-year average of $311 (U.S.). The benchmark price is calculated by Random Lengths, a U.S.-based forestry sector organization that tracks prices and industry issues. The composite price is a weighted average of 15 key framing lumber prices. The news is even better because of the soft Canadian dollar. The loonie was over parity with the U.S. greenback in 2013. Now, it sits around $0.91 (U.S). Lumber is priced in U.S. dollars but producers have to pay their operating costs in Canadian dollars, so the loonie’s relative weakness is boosting profits. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

1 Comment

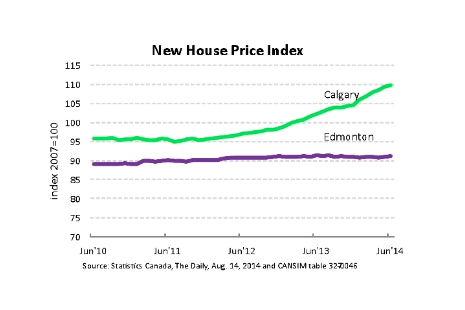

It continues to be a tale of two cities in Alberta when it comes to the price of a new home—and the tales in Edmonton and Calgary couldn’t be more different. According to the latest information released by Statistics Canada, the index of new homes in Calgary reached 109.7 in June (with the index of prices in 2007 set equal to 100). That’s 7.3 per cent higher than June of last year. Up the highway, Alberta’s capital city reported virtually no change in the price of a new home. Edmonton’s index in June stood at 91.1. Over the last four years, new home prices have been stuck essentially unchanged at close to an index of 90 (see chart). That means prices are nearly 10 per cent lower than they were in 2007. Both cities continue to do well economically and attract growing populations from interprovincial migration. The difference can be attributed to higher building costs in Calgary. Statistics Canada reports: “New home prices in Calgary rose ... as builders continued to report higher material and labour costs, good market conditions and higher costs for developed land as the reasons for the gain.” Over the last three years, the price of a new house in Calgary has risen by 14 per cent. The cost of the land itself has risen by 7.3 per cent. But the cost of building the house—which includes material and labour—has risen by a much steeper 19.3 per cent. **Article courtesy of Todd Hirsch, Chief Economist with ATB Financial. Thanks Todd!!

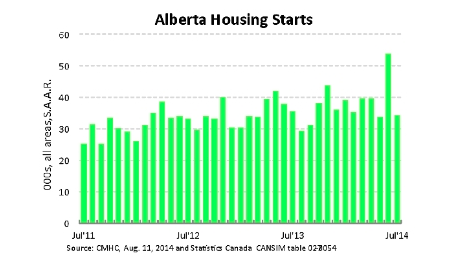

After an unusual spike in June, Alberta’s new housing starts are settling down to a level much more consistent with the long term trend. According to statistics complied by Canada Mortgage and Housing Corporation, there were 34,475 housing starts in the province last month. Since August of last year, housing starts have averaged just under 38,000 (annualized rate), about 8.2 per cent more than the 35,130 over the previous twelve-month period. (The figure is seasonally adjusted to smooth out the predictable fluctuations in activity. It’s also reported at an annual rate: that is to say it represents the number of homes that would be started in one year if the pace of building was maintained for twelve months.) The graph below shows the last three complete years of home building activity in Alberta. Generally speaking, housing starts have displayed a gradual but steady increase. The exception is June of 2014, a month in which starts jumped to an astonishing 53,853 (annualized rate). It is difficult to explain this anomaly in the data. It could be an error in the survey or perhaps starts spiked this high due to a combination of random events. Whatever the case, June’s sudden and steep jump is a great example of why one month of data should never be considered in isolation. The return to normal building levels in July is a reassurance that housing construction in Alberta is increasing steadily but at a more sustainable pace than in June. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

Well, it's really not a huge surprise for anyone who has been paying attention to the Calgary real estate market, that we are up up up across the board. In some areas, we are even outpacing the long-term ten year average. At the head of the surge are the condos pushing double digit increases in sales, pricing and inventory. Who knew? Well, we did.

May saw more than a thirty percent increase in the number of condos sold this year compared to last, and the average price has also increased anywhere from 3% to 16% where the apartment style condos are on the upper end of that range. Compared to last couple of months, the monthly additional inventory of condos (new listings) has increased steadily. For the month of March there were 1119 condos newly listed (combined townhomes and apartment style). April saw 1170, not much of an increase. In May however we're looking at an increase to 1390 units newly listed. Strangely in June, the number defied us and lowered to 1217 units introduced. Although there seems to be a stammering, keep in mind that there are as of right now there are 1629 units for sale in Calgary. So far this month, the number of new listings introduced total just 35. With respect to the condo market, a lot of talk has been centred around the higher price and the inventory numbers. If supply and demand become closer in volumes, we will approach a balanced market, where the seller and the buyer will have equal footing. This situation will also help to ease the price increases over the next while. However, if the inventory begins to run low and the influx is slow, we could see the prices climb even higher than they are now at current record highs. With these latest numbers, will it balance, or will it tip? We shall see. Something that most folks who have lived in Alberta for more than a few months know, is that whether it's football, universities or our biz, real estate, there is always ongoing competition between the two power cities.

With record setting sales in May of 2014, Calgary's residential housing market continued its upward surge. We're talking about a 16% increase in sales over 2013. Some didn't think it possible that the residential values would be able to sustain a steady increase, but they have. Low interest rates have definitely helped. Single-family homes gained a 10% increase in value over last year. This astonishingly brought the average home price of this class up to $504,300. A $50K gain in one year. That goes for condo values too (10.7% increase). It's happening all around us every day in Calgary. New builds are up up up to the tune of 5,857 new units in the first quarter of 2014 alone. A substantial 64% increase over this quarter 2013. Incredible. An interesting fact is that apartment construction was the largest contributor to this gain. It's a multi-family heaven for those looking to get into brand new homes. To summarily quantify the magnitude of the transactions going on in Calgary ... The majority of sales occurring are between $300 and $500K. The number of listings in this bracket are however declining. Instead, higher up the market in the amounts closer to the millions and above, we're seeing a surge in new listings. A quick search of a portion of West Calgary (Springbank Hill, Slopes, Aspen, Coach Hill and a few more favourites) for homes valued at $1million or more revealed well over 120 listings. In fact, I have just executed a search for homes valued over $1 million in all of Calgary to find that there are currently 558 listings starting at $1million. Back to the topic at hand, the same search of our neighbours to the north in Edmonton has yielded 177 listings. Calgary seems to be leading the charge when it comes to high-end product availability. Calgary single-family sales and new listings for 2014 to date are 8,175 and 11,950 units respectively. That means that of the 5,177 real estate agents and brokers in Calgary, each one of them could have had a deal, and for many even two or three. There doesn't seem to be a stranglehold on business in that ratio, which is a great incentive for agents to do their best to represent as many listings as they can in this lucrative climate. Single-family sales and new listings for 2014 to date in Edmonton totalled 4,746 and 7,590 units respectively. Of course we have to take into account that Calgary has a couple hundred thousand more residents than Edmonton. We can see from the numbers that there are definitely some differences between the two real estate markets north and south. Both markets are performing very healthily, however one seems to be a little more active over the broad spectrum of analysis ;) What can both cities look forward to in the next few months? So far it has been smooth sailing. Good returns for sellers with homes that buyers can still afford? Praise that low interest rate right now. Without knowing what will actually happen tomorrow in the market, the absolute best thing you can do is work with an agent that you trust on an ongoing basis. Together you will be prepared to make your decisions based on real knowledge from real professionals right at that critical moment you need to. |

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed