|

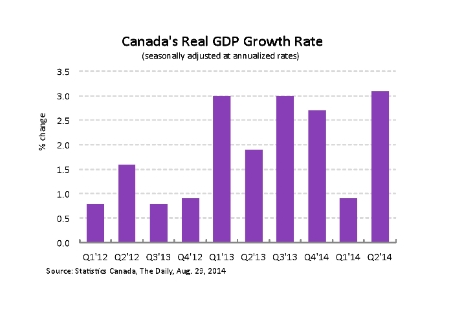

After a shaky start to the year, the Canadian economy roared to life in the second quarter of 2014. The latest figures of total economic output from Statistics Canada showed that the economy grew by 3.1 per cent during the months of April, May and June. The percentage growth measures the real gross domestic product (that is, the value of total output of good and services, removing the effects of inflation). It is also the quarterly change at annualized rates—meaning the percentage change that would be experienced in a complete year if the quarterly change was to be maintained for four quarters. The second quarter expansion is the strongest rate of growth the economy has seen since 2011. “The quarterly growth was a result of increased economic activity in all sectors of the economy except non-profit institutions serving households,” says Statistics Canada in its press release. Today’s report should cheer markets and policy makers, many of whom have become concerned about the Canadian economy stalling out in 2014. Two areas of greatest concern were exports and the slow growth in business investment (i.e., companies spending money on new plants, equipment and buildings). Fortunately, total business investment expanded smartly in the second quarter following two quarters of contraction. Exports also did well. Exports of goods and services increased 4.2 per cent (quarter-over-quarter) following a 0.2 per cent decline during the first quarter of the year. **Information provided by Todd Hirsch, Chief Economist with ATB Financial. Thanks Todd!!

1 Comment

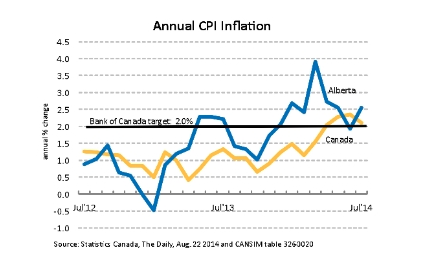

Consumers in Alberta saw prices rise, on average, at a faster pace in July than they did in June, according to this morning’s Consumer Price Index report from Statistics Canada. The all-items year-over-year increase in July was 2.5 per cent, up from a 1.9 per cent increase in June. Over the last twelve months, Alberta’s inflation rate has averaged 2.2 per cent, very close the Bank of Canada’s 2.0 per cent target for the entire Canadian economy. Canada’s inflation rate moved in the opposite direction, falling from an annual increase of 2.4 per cent in June to 2.1 per cent last month. The core inflation rate—which strips out the most volatile components of the index to get a better read on where true price pressures are—rose 1.7 per cent in the 12 months leading up to July, after increasing 1.8 per cent in June. Alberta’s inflation was led by significant gains in natural gas home heating costs, which jumped 41.8 per cent year-over-year. Natural gas prices have been particularly volatile for Alberta consumers over the last year. Other increases were noted in the price of home and mortgage insurance (+14.8 per cent) and fresh fruit (+11.5 per cent). Prices were lower compared to last year for electricity (-17.6 per cent) and public transportation (-1.0 per cent). Today’s inflation report will do little to change the Bank of Canada’s belief that there is still plenty of slack in the Canadian economy and that price pressures at the consumer level are not strong. **Article and research provided by Todd Hirsch of ATB Financial. Thanks Todd!!

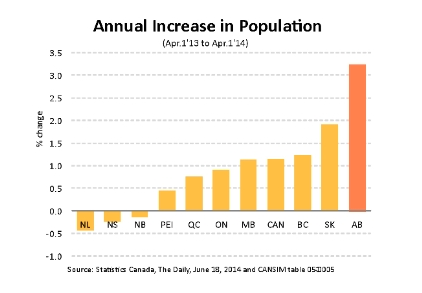

Alberta’s population continues to grow at a rate far faster than the national average. According to new estimates released this morning by Statistics Canada, the province’s population on the first day of April this year was 4,111,509. Canada’s total population was 35,427,524. Over the last year, Alberta’s population increased by 3.25 per cent—nearly triple the national average (+1.1 per cent) and almost double that of the second-fastest growing province, Saskatchewan. British Columbia and Manitoba come in third and fourth, respectively, making the western provinces the four fastest growing populations in the country. Three of the Atlantic provinces lost population, and Ontario and Quebec continue to grow at less than 1.0 per cent annually. The east-west split in population trends—and particularly the strong growth in Alberta—is being driven entirely by economics. Western Canada has a much better labour market which is luring interprovincial migrants who want work. With the lowest unemployment rates in the country, Saskatchewan (3.7 per cent) and Alberta (4.6 per cent) are the places to be if you’re looking for work. In the first quarter of 2014 alone, Alberta gained over 24,000 people from other provinces (while about 15,000 moved out of Alberta). The net gain was 9,581, which puts the province on track for a total net gain of close to 40,000 interprovincial migrants this year. **Article provided by Todd Hirsch of ATB Financial. Thanks Todd!!

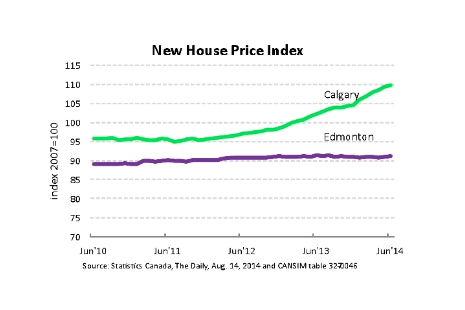

It continues to be a tale of two cities in Alberta when it comes to the price of a new home—and the tales in Edmonton and Calgary couldn’t be more different. According to the latest information released by Statistics Canada, the index of new homes in Calgary reached 109.7 in June (with the index of prices in 2007 set equal to 100). That’s 7.3 per cent higher than June of last year. Up the highway, Alberta’s capital city reported virtually no change in the price of a new home. Edmonton’s index in June stood at 91.1. Over the last four years, new home prices have been stuck essentially unchanged at close to an index of 90 (see chart). That means prices are nearly 10 per cent lower than they were in 2007. Both cities continue to do well economically and attract growing populations from interprovincial migration. The difference can be attributed to higher building costs in Calgary. Statistics Canada reports: “New home prices in Calgary rose ... as builders continued to report higher material and labour costs, good market conditions and higher costs for developed land as the reasons for the gain.” Over the last three years, the price of a new house in Calgary has risen by 14 per cent. The cost of the land itself has risen by 7.3 per cent. But the cost of building the house—which includes material and labour—has risen by a much steeper 19.3 per cent. **Article courtesy of Todd Hirsch, Chief Economist with ATB Financial. Thanks Todd!!

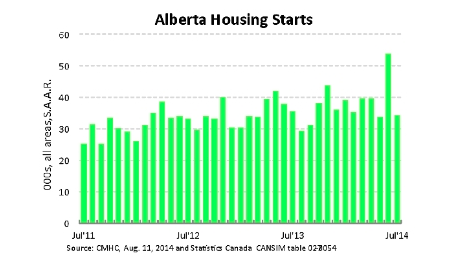

After an unusual spike in June, Alberta’s new housing starts are settling down to a level much more consistent with the long term trend. According to statistics complied by Canada Mortgage and Housing Corporation, there were 34,475 housing starts in the province last month. Since August of last year, housing starts have averaged just under 38,000 (annualized rate), about 8.2 per cent more than the 35,130 over the previous twelve-month period. (The figure is seasonally adjusted to smooth out the predictable fluctuations in activity. It’s also reported at an annual rate: that is to say it represents the number of homes that would be started in one year if the pace of building was maintained for twelve months.) The graph below shows the last three complete years of home building activity in Alberta. Generally speaking, housing starts have displayed a gradual but steady increase. The exception is June of 2014, a month in which starts jumped to an astonishing 53,853 (annualized rate). It is difficult to explain this anomaly in the data. It could be an error in the survey or perhaps starts spiked this high due to a combination of random events. Whatever the case, June’s sudden and steep jump is a great example of why one month of data should never be considered in isolation. The return to normal building levels in July is a reassurance that housing construction in Alberta is increasing steadily but at a more sustainable pace than in June. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

What happens after the seller has accepted your first, second or third offer? Often a buyer wants to relax and celebrate after their offer is accepted, especially if there were rounds of counter offers and acceptances. But some things need to happen pretty quickly after the contract is signed by all parties. This is a fairly good example of what actually happens most times. Not all contracts are the same. This is just a rough example of what usually happens in my transactions when I represent the buyer of a home, unless the contract requires us to do things differently than “the norm”.

SCHEDULE THE HOME INSPECTION Usually the very first thing I have my buyer clients do once the contract is “signed around” by all parties, is schedule the home inspection. Often people read the contract to mean that they have 5 to 10 days (every contract is different) to DO the inspection. That is not the case. During that very limited time frame: a) You have to “DO” The Inspection b) You have to review the results of The Inspection c) You have to think about what you may or may not want to ask of the seller as a result of that Inspection d) You have to cancel the contract, or accept the inspection, or submit any conditions of accepting the Inspection, in writing, so that it is RECEIVED by the seller or seller’s representative by the end of the time frame. You don’t want to wait until the last minute to “DO” the inspection. Call the inspector ASAP after the purchase contract is finalized and DO the inspection at the first available opportunity after the contract is signed around. By scheduling the inspection ASAP for the first available time, you should have sufficient time to digest what the inspector said at the inspection, and also to subsequently review the written inspection report after the inspector has left the property. You should allow about 3 to 4 hours for the actual inspection in most cases for an average sized single family home. THE HOME INSPECTION PROCESS The inspection is paid for by the buyer, usually before the inspection begins. The buyer usually attends the Home Inspection because it is not a PASS/FAIL kind of thing in most cases. It is also not ONLY about what is wrong with the house. A good home inspection gives the buyer a lot of information that is not all about what the buyer may want the seller to do to correct defects. Generally a Home Inspector will: a) Inspect the outside of the home first. Roof, siding, gutters, etc. VERY IMPORTANT: Most inspectors are inspecting “the home” and not the fence or the shed and sometimes not even decks, especially if they are not connected to the house. b) The inspector is usually not looking at cosmetic things that can be readily seen by the buyer prior to making the offer, such as a stain in the carpet. c) An inspector cannot see through walls, so having an experienced inspector who likely knows what is behind those walls based on the age of the house is very important. d) Since an inspector is not looking at cosmetic items, he will usually spend more time in bathrooms and kitchens, the attic and under the house, at the heater and electrical panel and hot water tank, than in a dining room or bedroom. In a bedroom he may check the outlets and the windows and make sure the door latches properly. In a kitchen or bathroom he will be checking appliances, looking for leaks under sinks, making sure the outlets in the rooms with water have appropriate and functioning GFCI (ground fault circuit interrupters) at the outlets. Often one GFCI will operate more than one outlet. e) Generally you do not need to take notes at an inspection, as the inspector will be providing you with a written report. Hopefully the report will have a summary of major problems and a separate summary of minor problems. Today Inspection Reports can be 85 pages long with lots of tips on home maintenance and other topics. So a one page summary of actual defects is helpful. IMPORTANT: If something is wrong with the property, you usually know it before you get the written report. If something comes up that causes you to not want the house at all, you may not want to complete the full inspection. In fact if you suspect that to be the case, you may ask the inspector to break from his normal routine and look at that item first. HOUSES ALMOST NEVER “FAIL” ON INSPECTION. Contracts often fail “on inspection” due to other issues, BUT “HOUSES” RARELY “FAIL” ON INSPECTION. Most often when a contract “fails on inspection” and “falls out of escrow” it is because of an erroneous or not reasonable expectation. The buyer isn’t doing what the seller expected the buyer to do, or the seller is not doing what the buyer expected the seller to do. Rarely does a real “deal-breaker” issue come up with the house, that the buyer and seller could not have known about in advance of the offer being made. Most often the contract fails because the buyer or the seller is not responding “appropriately” to an issue. That is usually an emotional problem, vs an actual “problem” with the house that can’t be rectified. Good “Rule of Thumb” is no seller should expect the buyer to want absolutely nothing at inspection, and no buyer should expect a seller to address everything the inspector talks about as needing to be done to the house. Instead of taking general notes during a home inspection, I find using a chart like this to be helpful during the inspection. The inspector says SO many things over a 3 to 4 hour period, so organizing them a bit while the inspector is there can help you raise questions at the end before the inspector leaves the premises. OWNER SHOULD – There are no hard and fast rules here. Many items the Inspector notes as “needing to be done” are things any owner needs to do periodically. Is “The Owner” the Buyer of the Home? Or is “The Owner” the Seller of the home? While contracts often fail over these issues, they should not as they are things the buyer will need to do during their ownership of the home. These are not “once and done” items. If the gutters are so clogged and dirty because the owner never had them cleaned during their ownership, the buyer may ask the seller to have those professionally cleaned prior to closing. The buyer may put this in the “Seller SHOULD” column. Often this has to do with the number of trees dropping debris into the gutters. Generally a buyer should not decide they do not want the house after all because the gutters are dirty and the seller won’t have them cleaned prior to closing, or because the seller won’t trim a small branch on a tree. Just because the Inspector tells the buyer “the gutters need to be cleaned” does not mean the seller needs to DO something. The Inspector may simply be saying that at EVERY inspection so the buyer knows that this is a normal owner maintenance item. That statement alone does not mean there is something currently “wrong” with the gutters. OWNER MUST – These are usually things the seller would have fixed had he known they were not functioning properly. They are usually things that have no aesthetic selection element, so that it doesn’t matter if the buyer does them or the seller does them. They are usually things that can cause a problem or additional damage between inspection and closing. As example, a leaking sink creates damage every day between the time you discover it and the time it is fixed, so having it fixed without delay is recommended. It is very rare that a seller would not want to fix that leak ASAP. SELLER SHOULD – Many items fall in here and are basically not major things. Often whether or not the seller “should” fix them has to do with the price of the home. If the buyer is paying a good and somewhat high “fair market value” then the buyer often expects these things to be done and the seller, happy with the price he got for the home, often does them. If the buyer is getting a screaming deal and the seller is walking away with nothing or less than nothing, the seller usually expects the buyer to accept the home with these issues not being addressed. Often these are things the seller did not deem important enough to fix while he lived there, and not something the seller did not know about. A small crack in a window. A broken window seal (this is cosmetic in most cases). A bedroom door doesn’t “latch” properly, which is often fixed by tightening knob or hinge screws or adjusting the latch plate. Basically things that can be fixed with little or no cost and a screw driver. WHICH ITEMS ARE CLOSE TO THEIR LIFE EXPECTANCY? These are usually large items that are “in working order” and not currently defective, but near or past their “life expectancy”. Roof is not leaking but 23 years old. Hot water tank is working just fine, but is 18 years old. Heater is working just fine, but is 30 years old. Again these items usually hinge on the price negotiated. If the Seller got the better end of the deal at initial price negotiation, the buyer’s expectations may be different than if the buyer is getting the home at a “below market” price. Often the seller and the buyer do not agree on THAT, on whether the price was at, above, or below market price and THAT is why the sale fails over one of these items. Not because of the item itself, but because the parties think one or the other is not being reasonable given the home price. Does a house need a new roof because it is “old” but is not leaking? Does a hot water tank need to be replaced because of it’s age when it is functioning well? Often these things are viewed differently in a Seller’s Market vs a Buyer’s Market. |

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed