|

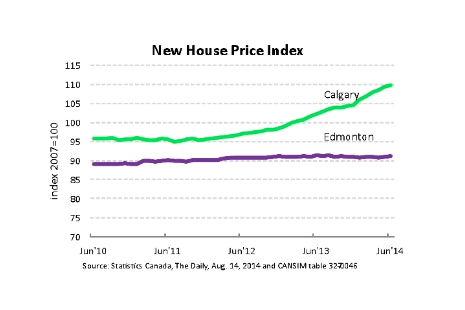

It continues to be a tale of two cities in Alberta when it comes to the price of a new home—and the tales in Edmonton and Calgary couldn’t be more different. According to the latest information released by Statistics Canada, the index of new homes in Calgary reached 109.7 in June (with the index of prices in 2007 set equal to 100). That’s 7.3 per cent higher than June of last year. Up the highway, Alberta’s capital city reported virtually no change in the price of a new home. Edmonton’s index in June stood at 91.1. Over the last four years, new home prices have been stuck essentially unchanged at close to an index of 90 (see chart). That means prices are nearly 10 per cent lower than they were in 2007. Both cities continue to do well economically and attract growing populations from interprovincial migration. The difference can be attributed to higher building costs in Calgary. Statistics Canada reports: “New home prices in Calgary rose ... as builders continued to report higher material and labour costs, good market conditions and higher costs for developed land as the reasons for the gain.” Over the last three years, the price of a new house in Calgary has risen by 14 per cent. The cost of the land itself has risen by 7.3 per cent. But the cost of building the house—which includes material and labour—has risen by a much steeper 19.3 per cent. **Article courtesy of Todd Hirsch, Chief Economist with ATB Financial. Thanks Todd!!

1 Comment

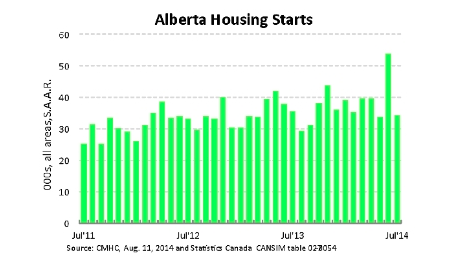

After an unusual spike in June, Alberta’s new housing starts are settling down to a level much more consistent with the long term trend. According to statistics complied by Canada Mortgage and Housing Corporation, there were 34,475 housing starts in the province last month. Since August of last year, housing starts have averaged just under 38,000 (annualized rate), about 8.2 per cent more than the 35,130 over the previous twelve-month period. (The figure is seasonally adjusted to smooth out the predictable fluctuations in activity. It’s also reported at an annual rate: that is to say it represents the number of homes that would be started in one year if the pace of building was maintained for twelve months.) The graph below shows the last three complete years of home building activity in Alberta. Generally speaking, housing starts have displayed a gradual but steady increase. The exception is June of 2014, a month in which starts jumped to an astonishing 53,853 (annualized rate). It is difficult to explain this anomaly in the data. It could be an error in the survey or perhaps starts spiked this high due to a combination of random events. Whatever the case, June’s sudden and steep jump is a great example of why one month of data should never be considered in isolation. The return to normal building levels in July is a reassurance that housing construction in Alberta is increasing steadily but at a more sustainable pace than in June. **Article courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

Well, it's really not a huge surprise for anyone who has been paying attention to the Calgary real estate market, that we are up up up across the board. In some areas, we are even outpacing the long-term ten year average. At the head of the surge are the condos pushing double digit increases in sales, pricing and inventory. Who knew? Well, we did.

May saw more than a thirty percent increase in the number of condos sold this year compared to last, and the average price has also increased anywhere from 3% to 16% where the apartment style condos are on the upper end of that range. Compared to last couple of months, the monthly additional inventory of condos (new listings) has increased steadily. For the month of March there were 1119 condos newly listed (combined townhomes and apartment style). April saw 1170, not much of an increase. In May however we're looking at an increase to 1390 units newly listed. Strangely in June, the number defied us and lowered to 1217 units introduced. Although there seems to be a stammering, keep in mind that there are as of right now there are 1629 units for sale in Calgary. So far this month, the number of new listings introduced total just 35. With respect to the condo market, a lot of talk has been centred around the higher price and the inventory numbers. If supply and demand become closer in volumes, we will approach a balanced market, where the seller and the buyer will have equal footing. This situation will also help to ease the price increases over the next while. However, if the inventory begins to run low and the influx is slow, we could see the prices climb even higher than they are now at current record highs. With these latest numbers, will it balance, or will it tip? We shall see. Something that most folks who have lived in Alberta for more than a few months know, is that whether it's football, universities or our biz, real estate, there is always ongoing competition between the two power cities.

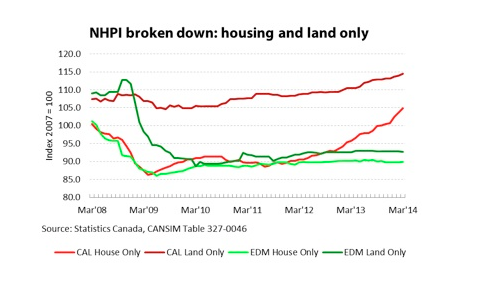

With record setting sales in May of 2014, Calgary's residential housing market continued its upward surge. We're talking about a 16% increase in sales over 2013. Some didn't think it possible that the residential values would be able to sustain a steady increase, but they have. Low interest rates have definitely helped. Single-family homes gained a 10% increase in value over last year. This astonishingly brought the average home price of this class up to $504,300. A $50K gain in one year. That goes for condo values too (10.7% increase). It's happening all around us every day in Calgary. New builds are up up up to the tune of 5,857 new units in the first quarter of 2014 alone. A substantial 64% increase over this quarter 2013. Incredible. An interesting fact is that apartment construction was the largest contributor to this gain. It's a multi-family heaven for those looking to get into brand new homes. To summarily quantify the magnitude of the transactions going on in Calgary ... The majority of sales occurring are between $300 and $500K. The number of listings in this bracket are however declining. Instead, higher up the market in the amounts closer to the millions and above, we're seeing a surge in new listings. A quick search of a portion of West Calgary (Springbank Hill, Slopes, Aspen, Coach Hill and a few more favourites) for homes valued at $1million or more revealed well over 120 listings. In fact, I have just executed a search for homes valued over $1 million in all of Calgary to find that there are currently 558 listings starting at $1million. Back to the topic at hand, the same search of our neighbours to the north in Edmonton has yielded 177 listings. Calgary seems to be leading the charge when it comes to high-end product availability. Calgary single-family sales and new listings for 2014 to date are 8,175 and 11,950 units respectively. That means that of the 5,177 real estate agents and brokers in Calgary, each one of them could have had a deal, and for many even two or three. There doesn't seem to be a stranglehold on business in that ratio, which is a great incentive for agents to do their best to represent as many listings as they can in this lucrative climate. Single-family sales and new listings for 2014 to date in Edmonton totalled 4,746 and 7,590 units respectively. Of course we have to take into account that Calgary has a couple hundred thousand more residents than Edmonton. We can see from the numbers that there are definitely some differences between the two real estate markets north and south. Both markets are performing very healthily, however one seems to be a little more active over the broad spectrum of analysis ;) What can both cities look forward to in the next few months? So far it has been smooth sailing. Good returns for sellers with homes that buyers can still afford? Praise that low interest rate right now. Without knowing what will actually happen tomorrow in the market, the absolute best thing you can do is work with an agent that you trust on an ongoing basis. Together you will be prepared to make your decisions based on real knowledge from real professionals right at that critical moment you need to. Alberta’s housing market is a tale of two cities. Since March of 2009, Calgary’s new house and land prices have increased 19.7 and 30.7 per cent, respectively. The story is a bit different in Alberta’s capital. The New Housing Price Index (NHPI) is calculated by using both contractors’ selling prices of new residential housing and their estimates of the current market price of the land. The NHPI is usually presented as one figure, but when we split Alberta’s to examine housing and land prices individually, we get a better look at the province's market. Developers and contractors continue to seek out viable land in Calgary, a demand that has been keeping prices up since 2009. Calgary’s prices for new homes are rising more sharply than contractors’ land price estimates. As the city's overall economy strengthens, demand for housing and usable land will rise. Edmonton is a different story. Since March 2009, the price of a new home has gone up 2.6 per cent. Contractors’ land price estimates have fallen 5.7 per cent. Both fell sharply in 2008 and haven’t seen any significant growth since the decline. It’s a mystery why Edmonton’s new housing prices and land estimates are still below 2007 levels. However, Edmonton’s healthy economy might help the numbers start to rebound. **Information provided by Todd Hirsch of ATB Financial. Thanks Todd!!

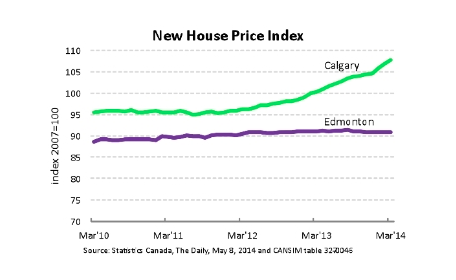

Prices of new homes in Calgary have posted the largest year-over-year increase among any city in Canada, according to new numbers from Statistics Canada. At the same time, prices in Edmonton have fallen flat. The latest information, released this morning, suggests the index of new homes in Calgary reached 107.8 (with the index of prices in 2007 set equal to 100). That’s 7.5 per cent higher than March of 2013. At the same time, Alberta’s capital city reported a small decrease. Edmonton's index in March stood at 90.9—about 0.1 per cent lower than a year ago. Over the last four years, new home prices have been essentially unchanged at close to an index of 90 (see chart). That means prices are nearly 10 per cent lower than they were in 2007. The contrast between prices in the major cities is puzzling. Both cities continue to fare well economically. Edmonton actually holds a slight advantage in the labour market: its unemployment rate in March was 4.8 per cent, slightly lower than Calgary’s 5.0 per cent rate (three-month moving averages). Some of the difference could be explained by the ongoing recovery from last year’s floods, which is still having an impact on material prices and building costs. With respect to Calgary’s hot market, Statistics Canada says: “Builders reported that higher material and labour costs, market conditions and the cost of developed land were the primary reasons for the increase.” **Information courtesy of Todd Hirsch of ATB Financial. Thanks Todd!!

Trading in Immovables?

People have been buying and selling real estate for many many years. Although it wasn't always referred to as, 'real estate,' the process has remained basically the same. The term, 'immovables' was used prior to 'real estate' to describe land and the structures on the land. Back then, buying and selling real estate would have been more familiar as 'trading in immovables.' Although the fundamentals are the same, the trading of property for an agreed upon payment, today's world is far more complex.. With this blog I'll talk about today's world of real estate. I'll talk about my experiences working in the industry, as well as the challenges that we face. So often unique, unforeseen issues can pop up and throw a deal sideways. The intent is to inform; whether buyers, sellers or real estate agents are reading, the topics that I discuss will be pertinent to anyone dealing with real estate. And now, a little history about real estate in Canada ... The History of Real Estate Organized real estate in Canada is almost as old as the country itself. The very first real estate board was set up in 1888 in the growing community of Vancouver. The first couple of decades of the 20th Century saw the creation of real estate boards in several cities across Canada. Origins in Political AdvocacyIn the midst of the Second World War, leaders of Canada’s real estate industry worried that certain government wartime measures might become permanent policy after the war. This included rent control and other rules relating to property. The industry decided to form a national organization that could influence the federal government's post-war planning. In 1943, a number of real estate boards drew up the first constitution of the Canadian Association of Real Estate Boards (CAREB). At its first conference in April, 1944, CAREB adopted the term "REALTOR®" for use by all of its member real estate professionals. Growth Through TechnologyIn 1951, CAREB created the “Photo Co-Op System” – the forerunner to Board MLS® Systems. The Photo Co-op System not only required organizations at the local level to establish rules and promote co-operation among agents, but also a means to fund the operation of the system. In 1955, CAREB actively promoted the Photo Co-op System, which led to the expansion of real estate boards across Canada. This is why most boards in Canada today date from 1955 or later. Governmental AffairsCAREB eventually evolved into The Canadian Real Estate Association (CREA). In 1986 the offices were moved from Toronto to Ottawa to facilitate CREA's increasingly important government lobbying activities. Over the years, CREA has worked with government to improve legislation and regulations that benefit property owners. CREA has successfully advocated on mortgage financing rules, anti-spam legislation, Employment Insurance for the self-employed and the Home Buyers Plan. |

AuthorSheri-Lee Presenger Archives

January 2016

Categories

All

|

|

SHERI-LEE PRESENGER

Real Estate Agent Real Estate Professionals Inc #100, 5810 2nd Street SW Calgary, AB |

The data included on this website is deemed to be reliable, but is not guaranteed to be accurate by the Calgary Real Estate Board.

REAL POWER - REAL ESTATE

RSS Feed

RSS Feed